The 4-1-1 on Form 990

Tax reporting can be a complicated topic, but knowing the basics can be beneficial to understanding your nonprofit organization.

Whether part of the management team, a board member, working with a granting agency or an individual donor looking to contribute, knowing the components of the Form 990 can provide insight into a nonprofit entity’s operations.

First, let’s talk about the Who, What, Where, and Why of the Form 990:

Who? Only tax-exempt entities, your standard charitable non-profit organizations or 501(c)(3) entities use the 990 tax form to report to the IRS. There are several tax-exempt organizations that fall under the 501 Code, but for our purposes, we will focus on the 501(c)(3) status. This status is generally given to entities seeking exemption for charitable, education or religious purposes.

What? Form 990 is an annual informational tax return that will include not only financial information about a tax-exempt entity but also organizational information for the year, such as governing board members, officers, related organizations and large vendors.

Where? The IRS makes clear by stating on the tax form itself that the 990 is “open to public inspection.” This public document should be available by requesting directly from the nonprofit organization. Some entities post their tax filings on their websites or other online sources, such as Guidestar.org, make this information available to the public. Additionally, the IRS has revamped its website and may include a recent 990 filing through their exempt organization database (Tax Exempt Organization Search).

Why? Form 990 allows for more accountability and enhanced transparency among tax-exempt organizations. Aside from compliance with IRS tax reporting requirements, Form 990 is a resource to help outside organizations (donors, grantors, and research agencies) understand more about a nonprofit organization or its specific industry.

Next, we’ll go into the different types of 990 tax forms.

990-PF: This form is specific to private foundations and non-exempt charitable trusts.

990-N: This basic filing is not precisely a tax form but rather an online filing referred to as an “ePostcard.” This return is filed directly through the IRS website and includes roughly eight basic questions about the entity. The 990-N is only intended for nonprofits that normally earn less than $50,000 in gross receipts for the year.

990-EZ: This form is a two-page return that will also include additional schedules. The 990-EZ is intended to be a more simplified Form 990 for nonprofits who generate gross receipts higher than $50,000 but less than $200,000 for the year. Additionally, it is intended for small entities with less than $500,000 held in assets.

990: This is the complete tax filing which includes far more information within its twelve-pages plus schedules than the 990-EZ and 990-N. We will mainly focus on this tax form as it is the more complicated and most widely used among nonprofit organizations. This “long-form” is used for tax reporting for entities with over $500,000 in assets or those that generate over $200,000 in annual gross receipts.

Form 990 is separated into different parts. To understand Form 990, it’s essential to identify what information can be found in each section of the tax form. As such, we’ll dissect the Form 990 so that you can pinpoint what information is most helpful for your review purposes.

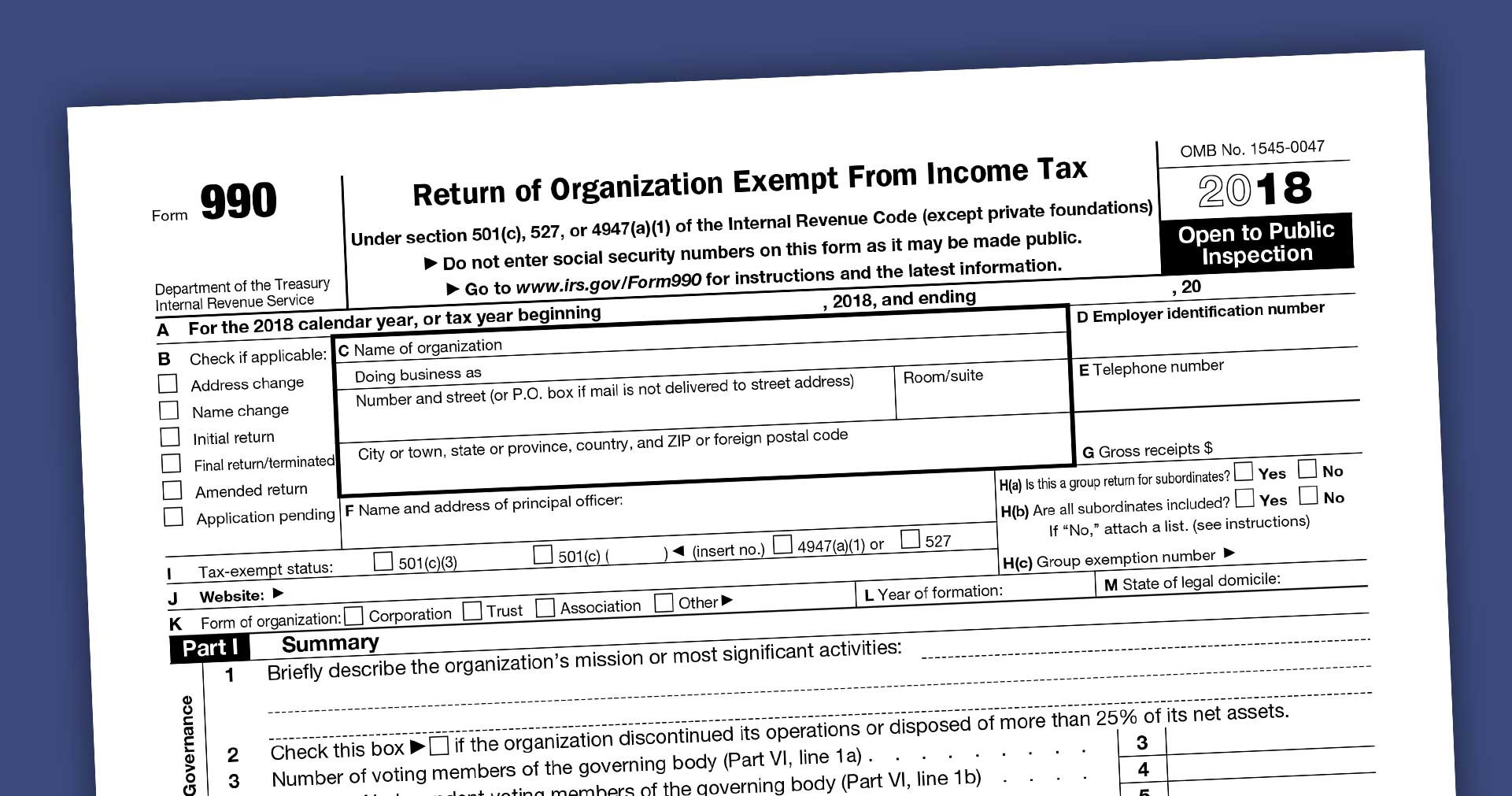

The top section of Form 990 focuses on the basic information: entity name, address, tax year, website, etc. It’s important to note for those entities that follow a fiscal year, which differs from the normal January through December calendar year that the “Tax Year” or date of your Form 990 is the calendar year that ends within the fiscal year. For example, a nonprofit with a fiscal year ending June 30, 2019, will file a 2018 Form 990 because the 2018 calendar year ended within the 2018-19 fiscal year.

Part I: Summary

This summary is on the face of Form 990 and provides a snapshot of the organization’s mission or activities, total number of board members, employees, and volunteers as well as summarized financial information. The detail of this summary information is found throughout the remainder of the form, or even further detail may be within an attached schedule.

Part II: Signature Block

This section seems straight-forward enough. The officer taking responsibility for the information provided to the tax preparer and for review of the tax form should be the signing party. The tax preparer will also complete their preparer information, which should include the firm’s ID and the preparer’s PTIN. This tax ID and PTIN are important items that all CPA and tax preparers must include for IRS purposes. Additionally, if the IRS may discuss the form information with the preparer, there is a question to note “Yes” or “No” at the bottom of the page.

Part III: Statement of Program Service Accomplishments

Think of this page as a brag sheet for the nonprofit. This section may very well be one of the most important parts of Form 990 for nonprofit organizations that are seeking donations or grants, as it allows the nonprofit to provide information about their program accomplishments. Aside from providing explanations about programs operated by the entity, revenue and expenses are noted for the top three programs.

Part IV: Checklist of Required Schedules

Beginning on Page 3, this section of Form 990 goes through a total of 38 questions to determine if further information is needed for reporting. The additional information would be reported on a separate schedule. Each schedule is its own unique form from A to O with specific instructions. It’s useful to know what these schedules are and what is most commonly included with the Form 990.

More description on the schedules are listed at the end of this article, but some of the more common schedules include:

Schedule A - the reason for the nonprofit’s charitable status

Schedule B – lists major donors and is the only schedule not open for public disclosure

Schedule D – additional information for assets and liabilities from Part X of Form 990

Schedule G – information on professional fundraisers and fundraising events

Schedule J – additional information on compensation from Part VII of Form 990

Schedule O – additional information or disclosure for any other item or areas of Form 990

Part V: Statements Regarding Other IRS Filings and Tax Compliance

This part of Form 990 focuses on compliance with other IRS filing requirements such as payroll (Form W-3 and employee W-2 wage statements) and vendor (Form 1096 and 1099 independent contractor pay) information as well as tax reporting for unrelated business income.

Part VI: Governance, Management, and Disclosure

Knowing about the types of policies and procedures in place allows for a better look at how a nonprofit organization is operating and whether best practices are in place. This section asks whether or not an entity has policies in place to address major areas such as conflicts of interest, compensation, document retention, board minutes, etc. Additionally, question 5 asks whether there was any “significant diversion of the organization’s assets,” which could be a key indicator of fraud or embezzlement.

Part VII: Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors

Board members, key personnel and significant vendors are listed within this section. Any calendar year compensation (wages, benefits or otherwise) would be noted next to the individual or contractor listed. Additional information on compensation would be further detailed in Schedule J.

Part VIII: Statement of Revenue

Financial information on contributions, program service fees, investments, and fundraising are reported in this part of Form 990. Beginning on this page, Form 990 becomes more focused on the numbers. Any further information regarding fundraising events would be noted on Schedule G.

Part IX: Statement of Functional Expenses

Financial information on expenses would be listed in this section. Expenses are allocated into three functions: program service, management and general and fundraising. Reviewing how expenses are allocated provides information on how a nonprofit is utilizing its funding. Since every nonprofit is different, there is no clear percentage allocation between function, but it is best to allocate more expenses to program services to promote the nonprofit’s exempt purpose.

Part X: Balance Sheet

Beginning and ending balances for financial assets, liabilities and net assets are presented in this section. Additional information is detailed on Schedule D, while tax-exempt bonds appear on Schedule K and loans with any interested persons (board members, employees, etc.) would be on Schedule L.

Part XI: Reconciliation of Net Assets

The reconciliation presents any differences from beginning to ending net assets plus includes line items for financial items that are not reported for tax purposes but would be reported for GAAP (i.e., unrealized gain/loss and donated services).

Part XII: Financial Statements and Reporting

The accounting method used by the organization as well as any services performed by an independent CPA (review or audit) would be noted in this section. Additionally, if the entity received significant federal funding, this section may tell you if the nonprofit complied with a required Federal Single Audit, if applicable.

Knowing what information goes where on the tax form can help tackle most questions that arise from review of Form 990. As you can tell, tax accounting can quickly get complicated, as evident by this “brief” article, and professional guidance can be a life-saver (and could save your tax-exempt status). This article should assist in helping you gain an understanding but not replace any tax compliance language provided by the IRS or other reporting agencies. For that, we recommend working with a trusted CPA at Christy White, Inc., for your nonprofit tax preparation needs.

Authored by

-

Marcy Kearney, CPA

Partner

Christy White

Christy White